US Section 301 Investigation: Impact on Brazil Trade Practices and Businesses

On July 15, the Office of the US Trade Representative (USTR) announced the initiation of a Section 301 investigation into Brazil’s trade practices to determine whether certain acts, policies, and practices of the Brazilian government are unreasonable or discriminatory and burden or restrict US commerce.

The investigation will focus on six key areas, including digital trade and electronic payment services, unfair preferential tariffs, anti-corruption enforcement, intellectual property protection, ethanol market access, and illegal deforestation (see here).

This action marks a significant development in US trade policy under the current Trump Administration, representing the first major Section 301 investigation of this term. The USTR’s decision follows longstanding concerns about Brazil’s trade barriers, as documented in the annual National Trade Estimate Report. The investigation was initiated at the direction of President Trump, who also announced plans to impose a 50% reciprocal tariff on imports from Brazil starting August 1, citing the need for reciprocal treatment.

Summary of Section 301 Actions

Section 301 of the Trade Act of 1974 authorizes the USTR to investigate and respond to foreign trade practices that are deemed unfair, unreasonable, or discriminatory and that burden or restrict US commerce.

If the USTR determines that such practices exist, it may take a range of actions, including:

- Imposing duties or other import restrictions on goods or services from the foreign country.

- Withdrawing or suspending trade agreement concessions.

- Entering into a binding agreement with the foreign government to eliminate the offending conduct or provide compensatory trade benefits.

The statute gives preference to the use of duties (tariffs) as a remedy. In cases not involving a trade agreement, such as the current investigation into Brazil, the USTR is generally required to make a determination within 12 months of initiation.

Scope of the Section 301 Investigation on Brazil

The investigation targets the following six categories of Brazilian practices:

- Digital Trade and Electronic Payment Services: Concerns that some Brazilian practices may undermine US companies’ competitiveness, for example, “by raising risks or costs for US businesses, restricting the ability of US companies to provide services or engage in normal business practices.”

- Brazil’s Unfair, Preferential Tariffs: Brazil has provided some countries with lower and preferential tariff treatment while applying higher tariffs to the US.

- Anti-Corruption Enforcement: Evidence suggests that Brazil’s lack of enforcement of anti-corruption laws and lack of transparency may disadvantage US companies operating in Brazil.

- Intellectual Property Protection: Brazil’s practices “deny adequate and effective protection and enforcement of intellectual property rights.”

- Ethanol Market Access: Brazil has high tariffs on US ethanol and has abandoned the reciprocal treatment that promoted the development of both US and Brazilian ethanol industries.

- Illegal Deforestation: Lax law enforcement allows agricultural and timber products cultivated on illegally deforested land to undercut US producers.

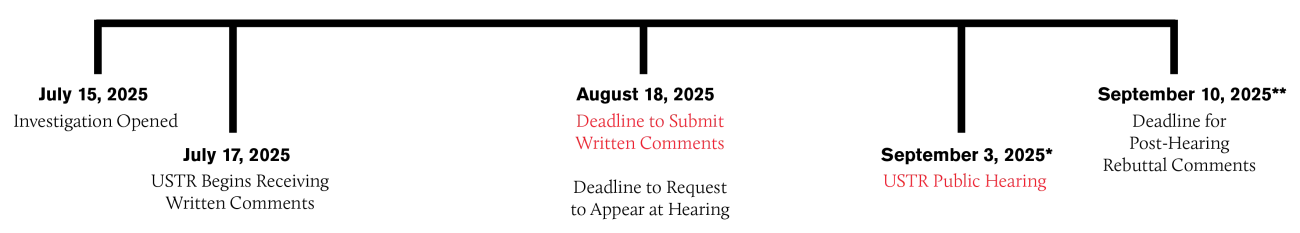

Timeline of Section 301, Including Stakeholder Input

Below, we provide a timeline of this Section 301 investigation, highlighting key dates for stakeholder input.

* If needed, the hearing will continue on September 4.

** If the hearing is continued to September 4, the deadline for post-hearing rebuttal comments will be September 11.

Interested parties — including companies, associations, and other stakeholders, whether US or foreign — may submit comments and requests to testify via the USTR’s electronic portal at https://comments.ustr.gov/s/ using docket number USTR-2025-0043 for written comments and USTR-2025-0044 for appearance requests.

Commercial and Strategic Implications

Companies with supply chains, investments, or commercial interests involving Brazil should closely monitor this investigation and consider the potential impact of new tariffs or other trade measures. Section 301 actions can significantly affect the cost and feasibility of importing Brazilian products, disrupt supply chains, and alter market access. Participation in the comment process and public hearing is an important opportunity to present data, arguments, and technical evidence relevant to the investigation.

For further information, please contact the authors of the alert or your regular AFS attorney. Our team is closely monitoring developments related to the Section 301 investigation into Brazil’s trade practices and is available to provide guidance on how these actions may impact your business, assist with the preparation of public comments or hearing participation, address any related trade compliance concerns, and provide government relations services as required.

Additional research and writing from Katarina Heffron, a 2025 summer associate in ArentFox Schiff’s Washington, DC, office and a law student at Georgetown University Law Center.

Contacts

- Related Practices