US Commerce Adds 428 HTS Codes to Section 232 Steel and Aluminum Tariff List

Following weeks of anticipation, the US Department of Commerce has issued its formal determination expanding the list of steel and aluminum products subject to the 50% ad valorem duties imposed under Section 232.

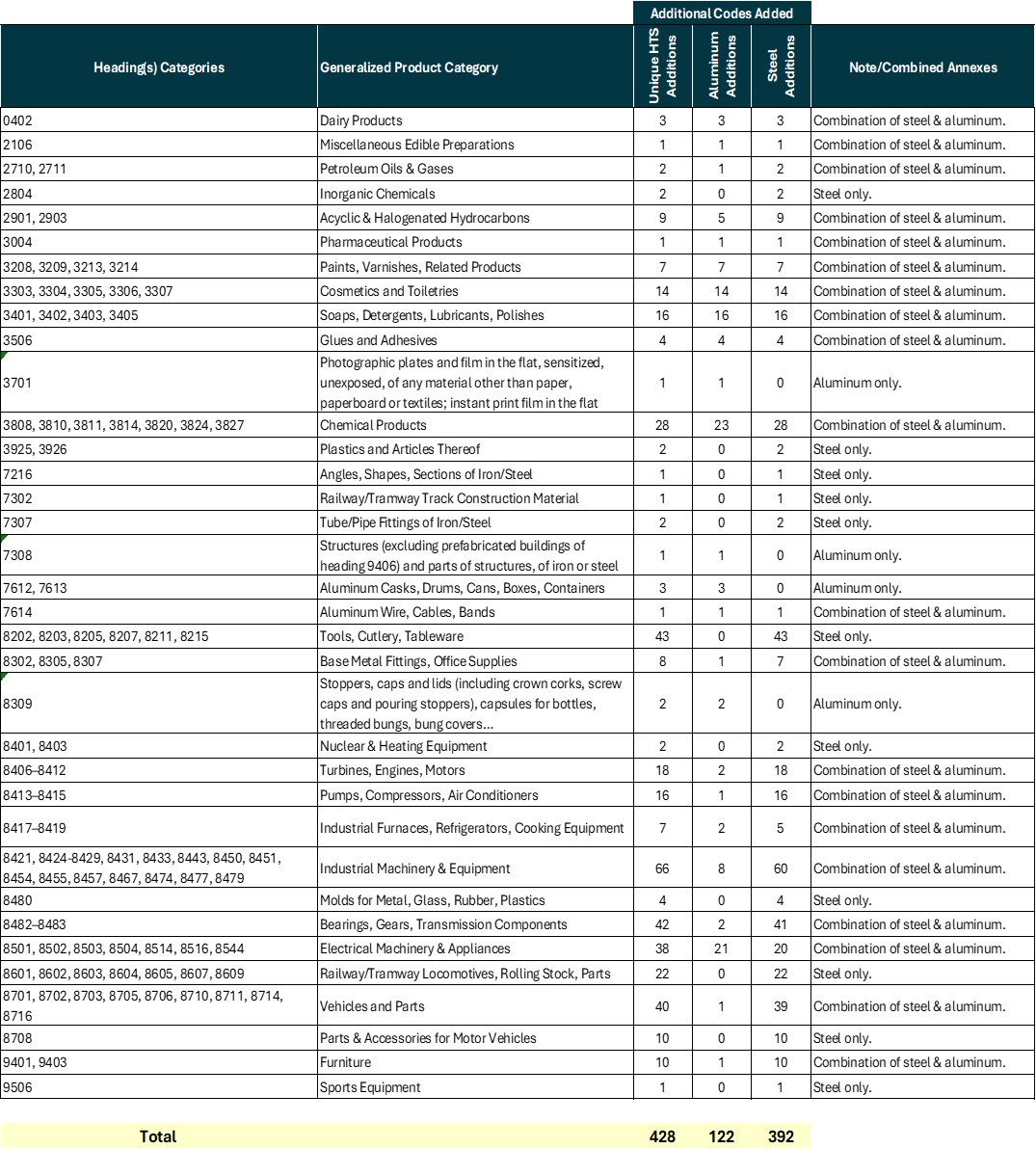

As outlined in the pre-publication Federal Register notice dated August 15, Commerce’s Bureau of Industry and Security (BIS) included 428 Harmonized Tariff Schedule of the United States (HTSUS) codes to the list of steel and aluminum derivative products subject to Section 232 duties. (The final number of new inclusions differs from the widely reported number of 407 Harmonized Tariff Schedule (HTS) inclusions.) This action became effective on August 18, giving importers minimal time to adjust or plan accordingly.

How We Got Here

The expanded list of covered articles is part of a new inclusion process announced back in February, through which Commerce established a mechanism for including additional “derivative” steel and aluminum products (i.e., downstream products that contain steel and aluminum) to the list of products subject to the Section 232 steel and aluminum duties.

Under this newly established process, US manufacturers and trade associations may petition BIS to add derivative products to the Section 232 action, even where those products fall outside HTSUS Chapters 72, 73, or 76.

The initial round of petitions opened on May 1 and concluded on May 15. During that interval, Commerce received 58 petitions covering several hundred derivative articles. Although the regulations indicated that the decision would be out within 60 days, BIS issued its determination on August 15, just weeks beyond its projected deadline. In the end, BIS included 428 new HTSUS subheadings — embracing an array of fasteners, wire products, tubular components, and other downstream assemblies — effective August 18, 2025.

What Is Covered

The scope of products is surprisingly broad, encompassing classifications not typically associated with steel or aluminum. Below is a non-exhaustive summary of the new additions subject to 50% tariffs.

Commerce indicated that 60 proposed subheadings were rejected because they are already under the scope of separate Section 232 investigations or other trade statutes. However, we note that HTS 8544.42.90, covering electrical cables, are now simultaneously subject to the existing aluminum duties as well as the recently imposed copper tariffs.

Current guidance from US Customs and Border Protection (CBP) provides no in-transit exemption or drawback. Covered derivatives admitted through a Foreign Trade Zone (FTZ) must enter under privileged-foreign status, effectively foreclosing the use of FTZs or drawback procedures to mitigate the new assessments, although articles manufactured wholly from US-origin steel or aluminum remain exempt.

CBP guidance lists set out the full roster of affected steel and aluminum derivatives, and the accompanying Federal Register notice clarifies that Section 232 duties apply only to the steel and aluminum content of each product, with non-steel and non-aluminum inputs continuing to bear the otherwise applicable tariff rates, including the reciprocal duties imposed under authorities such as the International Emergency Economic Powers Act.

What Is Coming

Going forward, BIS will open a two-week filing window three times a year, with the next one opening on or about the first of September 2025, followed by filing windows in January and May of the following year. Petitions must be submitted electronically through the BIS portal and must substantiate, among other things, the petitioner’s domestic production capacity, the alleged circumvention or undermining of the original Section 232 measures, and the rationale for applying the tariff to the specific derivative article at issue. Upon closure of each filing window, BIS will publish all valid petitions and invite public comment for a 14-day period, permitting interested parties — importers, end-users, or foreign producers — to submit comments in support or opposition.

Takeaways

- Review Expanded List of HTS Codes Subject to 232 Duties on Steel and Aluminum: Importers should promptly review their product lines to determine whether any items are now subject to the expanded Section 232 duties, as the new measures are already in effect and offer no in-transit or drawback relief.

- Monitor Opportunities for Future Inclusion Processes: Both importers and domestic producers are advised to closely monitor the ongoing derivative inclusion process, as future filing windows present opportunities to either challenge the inclusion of additional products or advocate for the addition of new HTS codes. The next two-week submission period is set to commence on September 1.

- Future Section 232 Actions Are Mirroring This Inclusion Process: The Section 232 Auto inclusion process was announced to start on July 1, but the initiation of this inclusion process through implementation via the Federal Register has been delayed. Notably, the process for copper derivatives is expected to mirror the steel and aluminum framework, with a similar petition and review mechanism anticipated in the coming weeks. This inclusion process might be the framework moving forward for other Section 232 actions, many of which are still waiting final determinations, including investigations into semiconductors, pharmaceuticals, polysilicon, and critical minerals.

- Removing/Challenging Listed Products: While there is currently no formal appeals process or clear pathway for removing HTS codes from the covered lists, the Secretary of Commerce retains significant discretion in both adding and potentially removing products. Stakeholders should remain vigilant and engaged as the regulatory landscape continues to evolve.

- Valuation and US-Content: The rules for valuation of steel and aluminum content within a derivative product, as well as the rules for exempting aluminum that is smelt and cast in the United States, or steel that is melt and poured in the United States, remain applicable to these new derivative products. These are novel rules that can provide opportunities to lower tariff exposure but should be applied under the advice of counsel given the complex application of these rules and high enforcement environment that importers are operating under.

Contacts

- Related Practices